Housing prices have been rising for almost four years now, and they were up over 5% nationwide in the year ending last November.

New home sales continue to rise, and probably have a lot of upside left.

Housing starts are likely to continue rising, as suggested by relatively strong builder sentiment and rising building permits. The housing sector is one of the economy's strongest.

As the chart above shows, new applications for home mortgages (not including refis) are up 40% from the levels that prevailed during 2014. 30-yr fixed conforming mortgage rates currently are 3.7%, and with the exception of 10 months in late 2012 and early 2013, have never been lower. If confidence continues to improve, there is every reason to think the housing market has plenty of upside.

Gasoline prices haven't been this low for a long time.

In response to substantially cheaper gas prices, vehicle miles driven have risen almost 5% since oil prices started to fall in mid-2014. Consumers and businesses are definitely responding to cheaper energy prices. Cheaper energy prices are likely working to stimulate more activity throughout the economy that has yet to show up in the statistics.

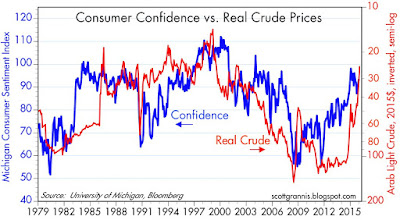

As the chart above shows, the big drop in real gasoline prices (shown here as a rising red line) has been an important source of rising consumer confidence.

A survey of small businesses shows that hiring plans continue to improve.

The U.S. consumer is far from being tapped out. Indeed, credit card debt as a percent of disposable income (the red line in the chart above) hasn't been this low for decades. After years of deleveraging, consumers are just beginning to return to the credit well.

This index of industrial commodity prices (CRB Raw Industrials) is up over 4% in the past two months. This leaves commodity prices more than 90% above their lows of late 2001, and suggests that demand is starting to pick up and/or supplies are starting to tighten. Despite the global weakness sparked by the slowdown in China, prices are not going down a black hole.

Bank lending to small and medium-sized businesses has been rising at double-digit rates for over five years. This reflects increased confidence on the part of businesses and banks.

After five years of very slow growth (2008-2013), bank credit is expanding at a more normal pace, up over 8% per year for the past two years.

Confidence is rising, there is no shortage of money or credit, businesses are hiring, cheaper energy prices are stimulating more activity, and the housing market is firing on all cylinders. This is not what you would expect to see if the economy were teetering on the brink of another recession.

No comments:

Post a Comment