We're now two weeks away from the December FOMC meeting, when it is widely expected—and feared—that the Fed will lift short-term interest rates for the first time since mid-2004. It's not yet a slam dunk, given today's weak ISM manufacturing report, but market pricing implies a 70% probability of a move, and short-term rates are already rising in anticipation. The bond market is doing its best to give the Fed the "all clear," and the stock market looks to be in agreement. This is great news.

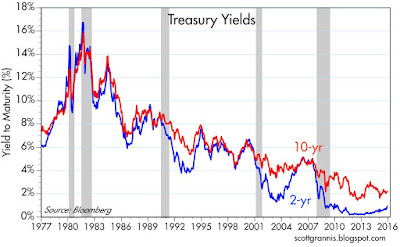

The two charts above put the Fed's upcoming move into historical context. The decline in interest rates which began 34 years ago is now coming to an end. 2-yr Treasury yields, which are equivalent to the market's expectation for the average Federal funds rate over the next two years, are now 0.9%, up from an all-time low of 0.16% in September 2011. They haven't been this high for over 5 years. 10-yr Treasury yields are now 2.15%, up some 75 bps from their all-time low of 1.39% in July 2012.

There's nothing unusual or scary about the current slope of the yield curve; it simply means that the market fully expects higher rates, but not so high as to threaten growth. The time to worry is when the yield curve becomes flat or negative, and we are probably years away from that. No one expects the Fed's upcoming or subsequent moves to threaten anything.

As the chart above shows, 3-mo T-bill yields have jumped some 20 bps in the past six weeks, after hugging zero for several years. Market participants are no doubt deciding that the yields available on alternatives—such as bank reserves and 3-mo LIBOR—are more attractive than earning nothing on bills: swapping out of bills into the alternatives is the logical maneuver. It's encouraging to see the price of the world's premier safe asset fall, since that suggests that the economic and financial market fundamentals have improved on the margin. Expect to see money market rates in general moving higher. Finally.

It's also encouraging to see that the recent rise in T-bill yields has been associated with a decline in the TED spread (the difference between the yield on 3-mo LIBOR and 3-mo T-bills). This spread has always been a good indicator of financial market stress. The current spread, about 20 bps, is almost exactly at the level you would expect to see during periods of normalcy. It's narrowed mainly because LIBOR yields have risen less the T-bill yields. As such, it reflects the dynamic of rising interest rate expectations, and not any deterioration of the fundamentals.

No comments:

Post a Comment